How much money can j borrow for a mortgage

To calculate the percentage ROI for a cash purchase take. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage.

Hard Money Loan Calculator

LIBOR or ICE LIBOR previously BBA LIBOR is a benchmark rate which some of the worlds leading banks charge each other for short-term loans.

. In 1882 Goldmans son-in-law Samuel Sachs joined the firm. Just because a bank says it will lend you 300000 doesnt mean that you should actually borrow that much. Bonds Interest rates also affect.

There are four positive considerations and one negative. This is an indicator of the. You can usually borrow as much as 80 or 85 of your equity depending on a few factors.

You can use home equity loan proceeds for home repairs college costs emergencies and more. Sadly many Christians base their handling of money more on how the world does it than on what the Bible teaches. Banks brokerages mortgage companies and insurance companies earnings often increaseas interest rates move higherbecause they can charge more for lending.

You can do some simple math to estimate how much you might be able to borrow. The loan is secured on the borrowers property through a process. Reverse mortgage An additional source of income for senior citizens other than the corpus they have amassed can be a reverse mortgage.

Our experienced journalists want to glorify God in what we do. Principal interest taxes and. A second mortgage is simply using an existing mortgaged property to borrow money from a financial institution says Jim Houston managing director of consumer lending and automotive finance.

Banks borrow money by accepting funds deposited on current accounts by accepting term deposits. In 2011 a year in which his wealth held roughly steady at 18 billion Bezos filed a tax return reporting he lost money his income that year was more than offset by investment losses. See chapter 4 for information on deducting interest and the allocation rules.

How Much Should You Pay. In economics a recession is a business cycle contraction when there is a general decline in economic activity. After the period is over the ownership of the house is transferred to.

Find out how much you can afford to borrow with NerdWallets mortgage calculator. Godly financial integrity means raising money in a biblical way. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home.

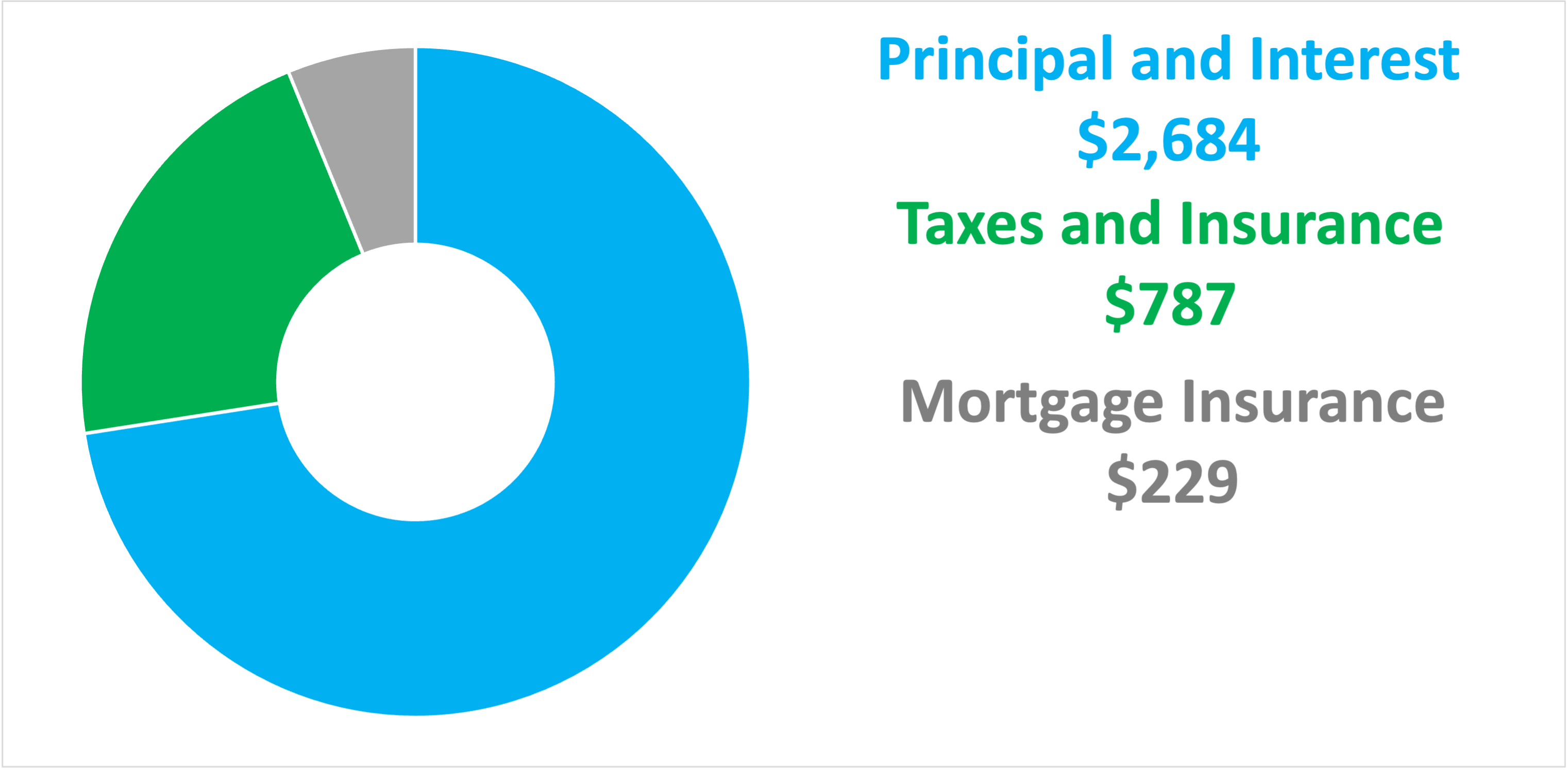

The United States has the most banks in the world in terms of institutions 5330 as of 2015 and possibly branches 81607 as of 2015. Total monthly mortgage payments are typically made up of four components. Recessions generally occur when there is a widespread drop in spending an adverse demand shockThis may be triggered by various events such as a financial crisis an external trade shock an adverse supply shock the bursting of an economic bubble or a large.

The general rule is that you can afford a mortgage that is 2x to 25x your gross income. The remaining 30 is personal interest and is generally not deductible. Return on investment ROI measures how much money or profit is made on an investment as a percentage of the cost of that investment.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to.

The company pioneered the use of commercial paper for entrepreneurs and joined the New. In 1885 Goldman took his son Henry and his son-in-law Ludwig Dreyfuss into the business and the firm adopted its present name Goldman Sachs Co. The best opinions comments and analysis from The Telegraph.

Todays national mortgage rate trends. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. The new borrower wouldnt have to apply for a new loan pay for closing costs or possibly risk paying higher interest rates.

It stands for Intercontinental Exchange London. Size of global banking industry. As a result youll only borrow 160000 which you can pay off with a 30-year mortgage.

How Much Money Stock Day Traders Make The above scenario indicates it is theoretically possible to make more than 20 per month with day trading. Many first-time homebuyers make this mistake and end up house poor with little. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective.

How much house can I afford. Transferring a mortgage can simplify things. A home equity loan is a type of second mortgage that lets you borrow money based on how much equity you have in your home.

For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to. This is very high by typical standards and most traders should not expect to make this when accounting for real-world issues such as slippage and not always being able to get the full position they. However many kinds of.

The church should raise money by teaching biblical principles of personal financial management. Goldman Sachs was founded in New York City in 1869 by Marcus Goldman. Here a house that the senior citizen owns is mortgaged with a bank which pays a predetermined amount over the period of the mortgage.

And the sub-prime mortgage crisis in the 2000s. Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase. For example if you borrow money and use 70 of it for business and the other 30 for a family vacation you can generally deduct 70 of the interest as a business expense.

You can often choose how large of a down payment to make and the decision is not always easy.

Can I Borrow Cash When I Do Not Have A Bank Account Mortgage Brokers Business Loans Mortgage Loans

My Dad Passed Away And I Ve Been Paying His Mortgage How Can I Get The Loan Put In My Name Fox Business

Apply Online Today Get Approved Car Title Loans Only With Canadian Title Store We Provide Loans In Calgary Alberta And T Edmonton Alberta Alberta Car Title

Pin On Home Buying Tips And Tricks

Payday Installment Loan Singapore Money Lender Installment Loans Loan Consolidation

How Much Mortgage Can I Afford Smartasset Com

Mortgage Calculator How Much Can I Borrow Nerdwallet

Get Knowledgeable About Cost And Working Of A Loan Before Borrowing Scoopify Lotto Gewinnen Lotto Spielen Lotto

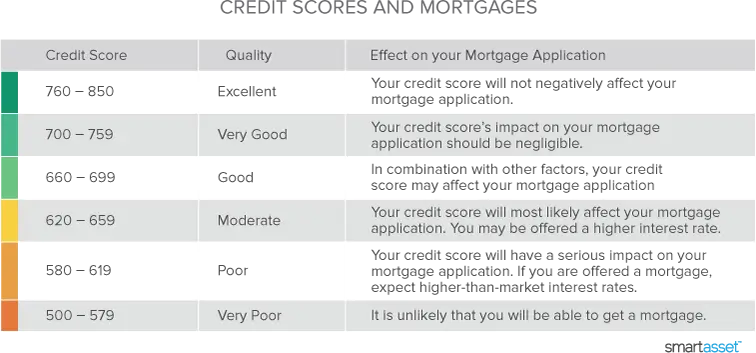

Credit Score Chart And How This Helps You Get The Lowest Interest Credit Score Chart What Is Credit Score Credit Score

How Much House Can I Afford Calculator Money

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Calculator How Much Can I Borrow Nerdwallet

Does It Still Make Sense To Put Down 20 When Buying A Home Cnn Underscored

How Much A 250 000 Mortgage Will Cost You Credible

Never Borrow Money For These 5 Buys Borrow Money The Borrowers Mortgage Payoff

Pin On Finance

500k Mortgage Mortgage On 500k Bundle